Project Generator

The Opportunity

By maintaining a healthy treasury, Eagle Plains has been able to acquire quality mineral exploration properties during industry downturns through staking and arrangements with third parties. These include multiple projects that have had millions of dollars in exploration expenditures by previous operators.

The Challenge

Mineral exploration is extremely capital-intense, ore-grade discoveries are very rare and few discoveries develop into mines. It is estimated that 1 of 3000 exploration projects will eventually become a mine, these are tough odds! Statistically speaking, funding 100% of the exploration costs on multiple projects is extremely risky from a capital perspective but, on the other hand, exploring multiple projects enhances exposure to discovery.

The Solution

Eagle Plains focus is to maintain a tight share structure and healthy treasure while advancing multiple exploration projects. Before the term “Project Generator” was coined, Eagle Plains realized that having partners fund exploration on its projects in turn for earning an interest provides a solution for divesting risk. In this way, Eagle Plains reduces exposure to the financial risk of exploration but maintains exposure to the upside of mineral discovery. This is the basic strategy of the Project Generator model.

How it works

- Eagle Plains acquires an exploration project and takes on the initial level of risk, in the $10’s of thousands range, by incurring the cost of research and staking then funding early exploration programs to build a case for the project’s mineral potential. Some of these projects pass this test while others do not.

- The project’s mineral potential is then promoted to other exploration companies interested in exploring in that jurisdiction and/or for that commodity.

-

Once another company is interested, earn-in terms are negotiated and an option agreement is formed. Terms vary depending on many factors but are typically as follows (note: the optioning company’s level of risk is in the $millions):

-

Over a 3 to 5 year period the optioning company will commit to:

- Pay Eagle Plains $1M cash

- Pay Eagle Plains 1M of its shares

- Fund $3M - $5M exploration -

Upon satisfying these terms Eagle Plains:

- transfers a 60% interest in that project to the option company

- retains 40% interest and a 2% royalty in the form of an NSR

- may elect to proceed as a Joint-Venture and proportionately fund future programs

Occasionally the option provides for a 2nd phase where the company may increase its interest in the project by funding additional tasks.

-

Besides preserving the treasury and maintaining a tight share structure, there are other benefits of the project generator strategy:

- Multiple exploration programs can be conducted during any given year

- Programs can be carried out by different exploration teams that bring differing sets of knowledge and experience

- This “shotgun” approach exposes Eagle Plains shareholders multiple opportunities of discovery at any given time

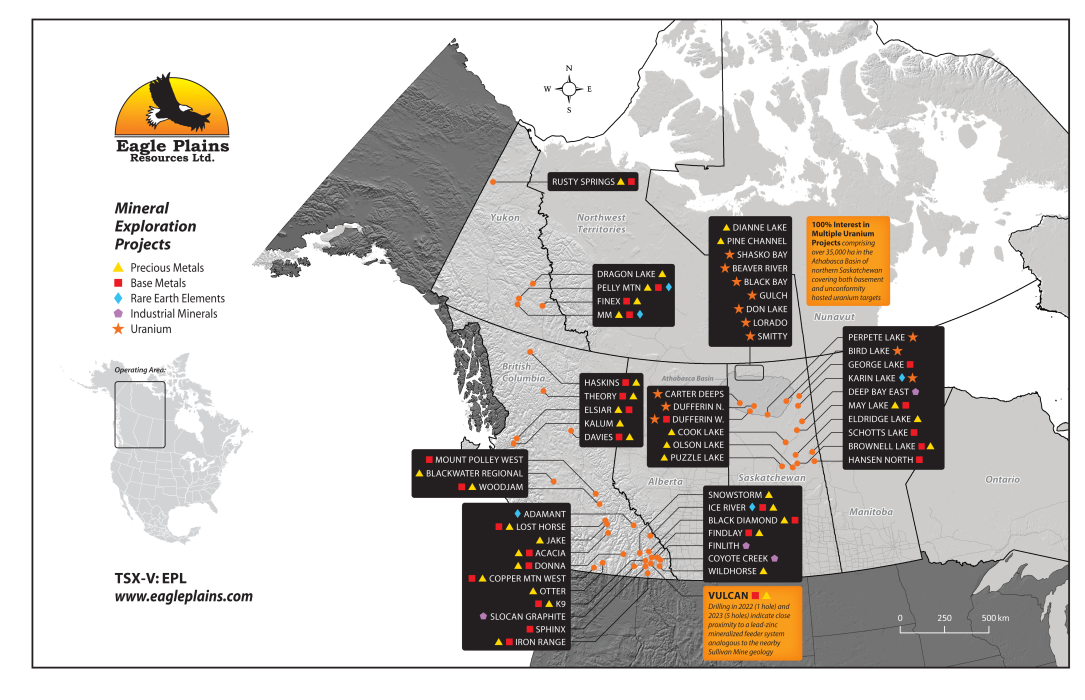

Today, with over 50 projects in British Columbia, Saskatchewan and Yukon, and many more in the pipeline, Eagle Plains continues to utilize the project generator model to advance these toward discovery.

Latest News Releases

Eagle Plains and Sun Summit Minerals Execute Option Agreement for the Theory Copper-Gold Project, British Columbia

Eagle Plains and Earthwise Minerals Execute Option Agreement for the Iron Range Gold Project, British Columbia

Eagle Plains and Partner Refined Energy Receive Permit for Drilling at Dufferin West Uranium Property, Saskatchewan

Eagle Plains Announces Letter of Intent with Earthwise Minerals for Option of the Iron Range Project, British Columbia

Eagle Plains Partner Xcite Resources Reports Results From Fieldwork at the Uranium City Area Projects, Saskatchewan